As entering the property market has proved to be increasingly difficult, the Federal Government Initiative has new spots available for the Family Home Guarantee. The Family Home Guarantee supports eligible single parents with dependents to purchase a family home with a deposit as little as two per cent.

Understanding the Family Home Guarantee

As of 1 July 2022, there are 5,000 new spots available for the Family Home Guarantee.

The Family Home Guarantee aims to support eligible single parents with at least one dependent child in purchasing their family home with a minimum deposit of two per cent without being required to pay Lender’s Mortgage Insurance.

Eligible single parents with dependents are those looking to enter, or re-enter, the property market sooner. This Guarantee is available to eligible single parents, not limited to first-time buyers.

The Family Home Guarantee can be used in conjunction with other Government Initiatives including, but not limited to, the First Home Owners’ Grant and Stamp Duty Concessions.

Understanding Buyer Eligibility

To be eligible for the Family Home Guarantee, you must be a single parent with at least one child dependent.

You must be an Australian Citizen who is at least 18 years old.

The Guarantee is not limited to first-time buyers looking to enter the property market. It is available to all eligible single parents looking to purchase their family home. As the name suggests, this Guarantee is only available to owner-occupiers and will not be available for investment properties.

To be deemed as a single parent, you must not be married or in a de-facto relationship. Unfortunately, if you are separated but not divorced, you may not be eligible for the Family Home Guarantee.

As the single parent applying, your taxable income must not exceed $125,000 per annum for the previous financial year. If you receive Child Support Payments, it is not included as income for the income cap.

You must be able to service for a loan by yourself through a participating lender and be the only name listed on the certificate of title.

You will be required to have at least two per cent of the value of the property available for the deposit.

What are eligible properties?

For the property to be eligible for the Family Home Guarantee, it must be a residential property.

Eligible residential properties may include:

- An existing house, townhouse or apartment

- A Home & Land Package

- Land purchase, and separate contract to build the home

- An off-the-plan apartment or townhouse

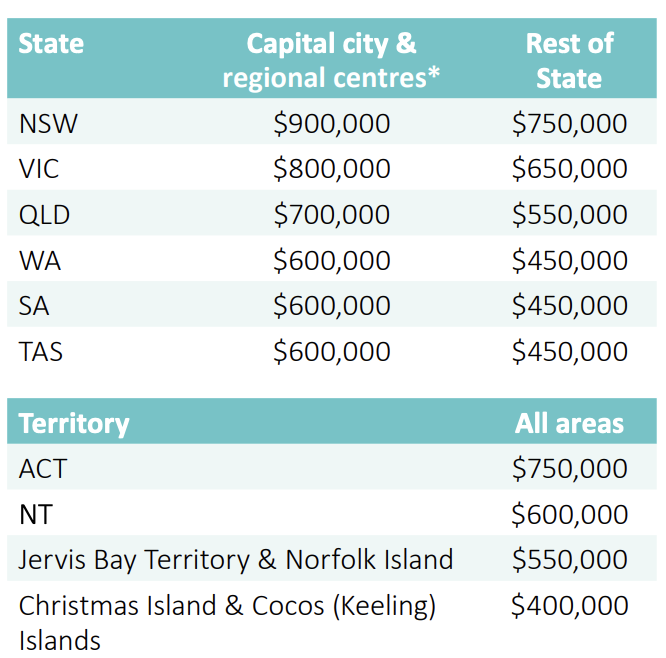

There is a property price threshold that must be met for a property to be eligible for the Family Home Guarantee. The price cap Capital City & Regional Centres and the rest of the State are:

How to Apply for the Family Home Guarantee

The National Housing Finance and Investment Corporation has selected banks to be the Participating Lender for the Family Home Guarantee.

To apply for the Family Home Guarantee, you must apply through your authorised representative (a bank or mortgage broker).

Click here if you are interested in receiving a Free Homeownership Assessment to see if you are eligible for the Family Home Guarantee.