Low interest rates, a dwindling market supply and a fear of missing out among buyers are pushing property prices through the roof. As a parent looking to enter or re-enter the property market, especially those with a low deposit, the time to act is now with the help of the new Family Home Guarantee.

What is the Family Home Guarantee?

The release of the 2021-22 Budget brings with it good news for single parents trying to enter the property market. The government announced its new Government Initiative called the Family Home Guarantee.

Does the Family Home Guarantee assist with deposits?

This new initiative allows eligible single parents with dependents the ability to purchase an existing home or buy/build a new home with a deposit of 2%.

When will the Family Home Guarantee become available?

Applications for the Family Home Guarantee open on 1 July 2021.

Who will it help?

The Family Home Guarantee is aimed at single parents with dependants own a family home. The new Government Initiative will assist 10,000 families each financial year.

How will the Family Home Guarantee help in this current market?

The current market demand has made it increasingly difficult for first home buyers to secure government support, so this initiative was designed to assist those who don’t feel like they will be able to afford their first home due to their lack of a partner. This guarantee helps single parents who might be able to afford a home if they had that extra support.

Is it only available for first-time home buyers?

The Family Home Guarantee is available for single parents that are looking to buy their family home, regardless if the single parent is a first home buyer or previous owner-occupier.

What is the benefit of the Family Home Guarantee?

The benefits of the Family Home Guarantee is that it opens up the possibility of homeownership to many potential applicants who could not support a 20% home deposit. Unlike the First Home Loan Deposit Scheme, it understands even further the adversities faced by single parents and offers an even lower deposit figure of 2%.

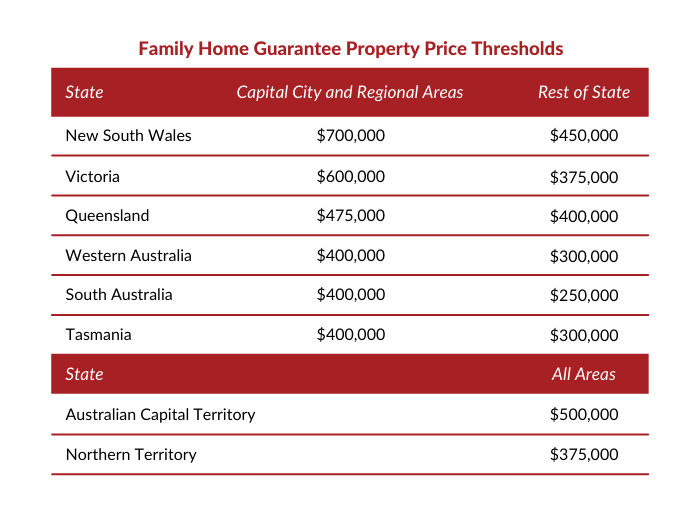

Property Thresholds:

The property price thresholds for the Family Home Guarantee will be the same as those applying for the First Home Loan Deposit Scheme.

Eligibility:

To be eligible for the Family Home Guarantee, the applicant must:

- Be an Australian Citizen over the age of 18 years (Permanent residents are not eligible).

- The single parent must have a taxable income that does not exceed $125,000 per annum (Child support payments are not included as income).

- Demonstrate that they are the parent of a dependent child.

- Individuals must have at least 2% of the value of the property available as a deposit.

- Applicants must intend to be owner-occupiers of the purchased property.

- Applicants can be either first home buyers or previous owner-occupiers who do not currently own a home.

You are now able to apply for your new home online! Click here and complete the form to assess your eligibility for a new Family Home Guarantee Government Initiative.