What’s the outlook for the Australian property markets for 2023?

Australia’s housing market downturn is gathering momentum as consecutive rate hikes, rising inflation and weaker consumer confidence places additional pressure on both housing values and buyers. As the market continues to deflate, what should we expect going into 2023?

Rising of Interest Rates

Australian house prices are expected to drop even further as interest rates continue to surge into 2023. Australia’s median property value has dropped by 2 per cent since the beginning of May, to $747,800— a figure that includes houses and apartments, the latest housing data shows.

CoreLogic’s Research Director, Tim Lawless, said “Although the housing market is only three months into a decline, the national Home Value Index shows that the rate of decline is comparable with the onset of the global financial crisis (GFC) in 2008, and the sharp downswing of the early 1980s. In Sydney, where the downturn has been particularly accelerated, we are seeing the sharpest value fall in almost 40 years.”

While the initial triggers for the downturn were increasingly unaffordable housing and higher levels of supply as motivated sellers timed the market to take advantage of peaking prices, rate hikes and changing consumer sentiment are now starting to have a major effect.

Consumer Sentiment and Confidence

Consumer sentiment and confidence levels have had a significant role to play in how the property cycle pans out. Lower levels of buyer confidence in recent months have contributed to slowing price growth. As the property market strengthens, so will the buyers as they start to compete harder for fear of missing out. Many factors relating to the supply and demand of property in certain suburbs have caused friction amongst both property prices and buyer interest.

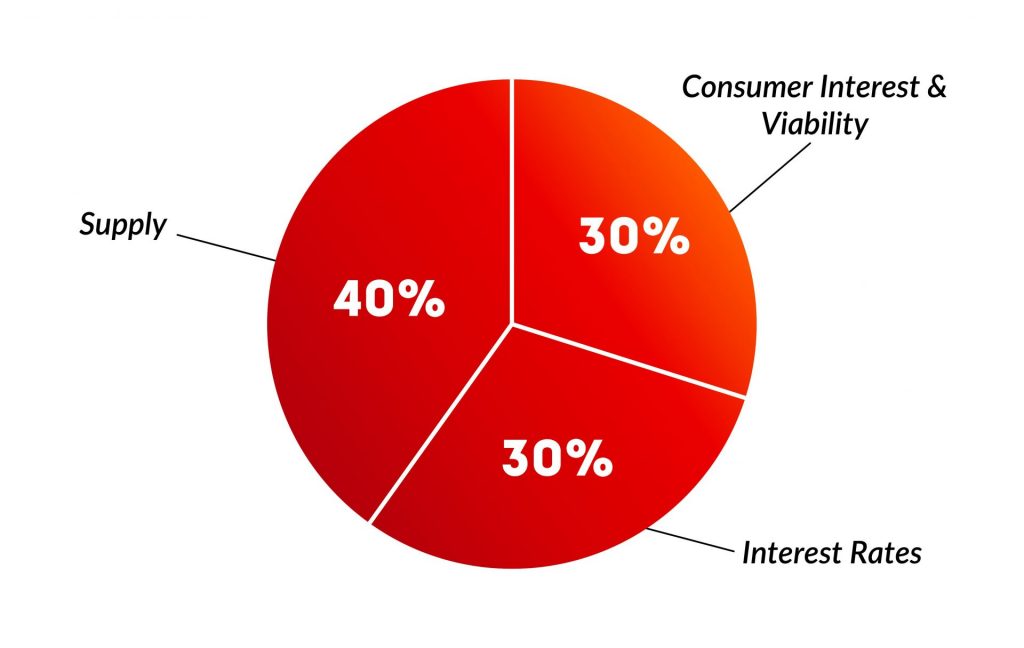

This is best explained by PRD Real Estate chief economist Dr Diaswati Mardiasmo as a ‘property pie’ graph (depicted below).

All these factors work synonymously to inform buyers’ decision-making, which translates to less or more competition in the market, ultimately affecting property prices.

Before Entering the Property Market

As interest rates and the property market have changed dramatically in recent months, it’s important to reassess your expectations. If you are looking to enter or re-enter the property market, it is important to be prepared. Get your finances ready, understand the due diligence process, know how to work out the right price to pay and move forward with confidence.

Navigating a transitional property market can be tricky but knowing your borrowing power can help you maintain a strong position. Pre-approval is a great way to validate your assumptions and then work out the right next step for your circumstances. Receive a Free Homeownership Assessment to start your finance process.

Takeaway

There it is, the current Australian property market was a mixed bag. But with the right knowledge and buying strategy, you can still score a great deal and make big profits in your first year of investing.

If you’re like many property investors, you’re probably wondering what you should do right now.

Should you buy, should you sell, or should you just wait?

You can trust the team at QLD Property Group to provide you with direction, guidance, and results.

Whether you’re a beginner or an experienced investor, in times like these, you need an industry expert who takes a comprehensive approach to wealth creation.

At QPG, we offer a range of real estate services that can assist you in your next property purchase. Book an appointment with one of our esteemed property experts to take advantage of the property market and discover what property options best suit your situation in 2023.